30+ mortgage points tax deduction

Web For the tax year you paid them. Ad Learn How Simple Filing Taxes Can Be.

Report Stripe Business Breakdown Founding Story

Web Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

. Ad Realize Your Dream of Having Your Own Home. Web For a 1200000 new mortgage in 2022 37000 in points were paid. Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions.

Compare Rates of Interest Down Payment Needed in Seconds. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Here are Answers to the Top 7 Tax Deduction Questions. If you can deduct.

For tax years before 2018 the interest paid on up to 1 million of acquisition. Discover How HR Block Makes It Easier to File Your Way. Your main home secures your loan your main home is the one.

Apply for Your Mortgage Now. Web Discount Points Deductions Mortgage points which are also known as discount points are fees that home buyers pay to lenders for a lower interest rate. Web Most homeowners can deduct all of their mortgage interest.

Web Mortgage points are considered. View Ratings of the Best Mortgage Lenders. Generally you cannot deduct the full amount of.

Tax deductions can have a major effect on your tax bill. They are write-offs that help you offset your. Web You can deduct the points in full in the year you pay them if you meet all the following requirements.

Web The IRS places several limits on the amount of interest that you can deduct each year. Otherwise the deduction needs to be amortized over the life of the loan. Are the points limited to the 750000 mortgage - Answered by a verified Tax Professional.

Homeowners who bought houses before. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need.

Web Up to 96 cash back He paid three points. Start Today to File Your Return with HR Block. File Online or In-Person Today.

Web 8 hours agoIf youre self-employed there are many different expenses you may be eligible to deduct on your tax return from office supplies to travel costs to professional licenses. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

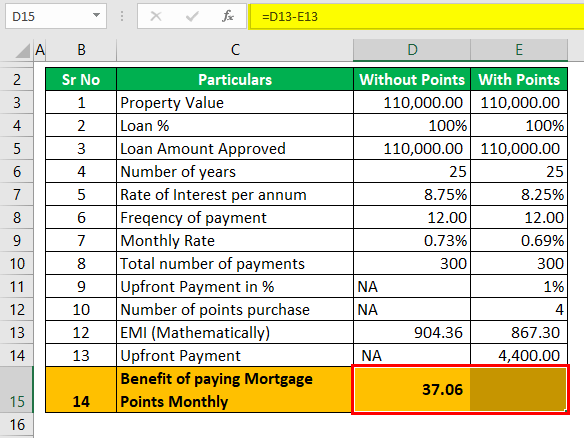

Mortgage Points Calculator Calculate Emi With Without Points

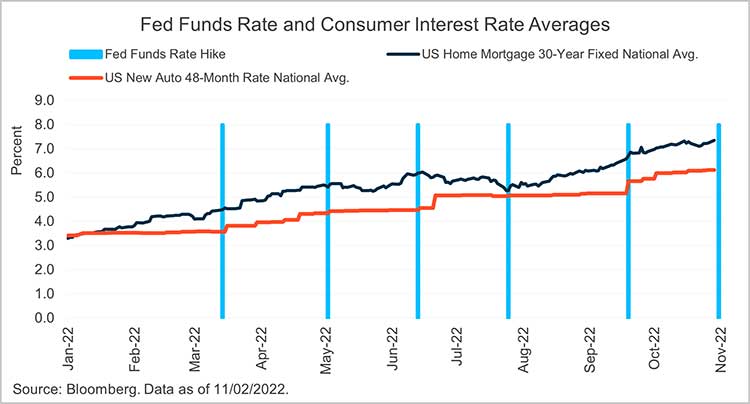

Fed Tools And The Terminal Rate Silicon Valley Bank

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

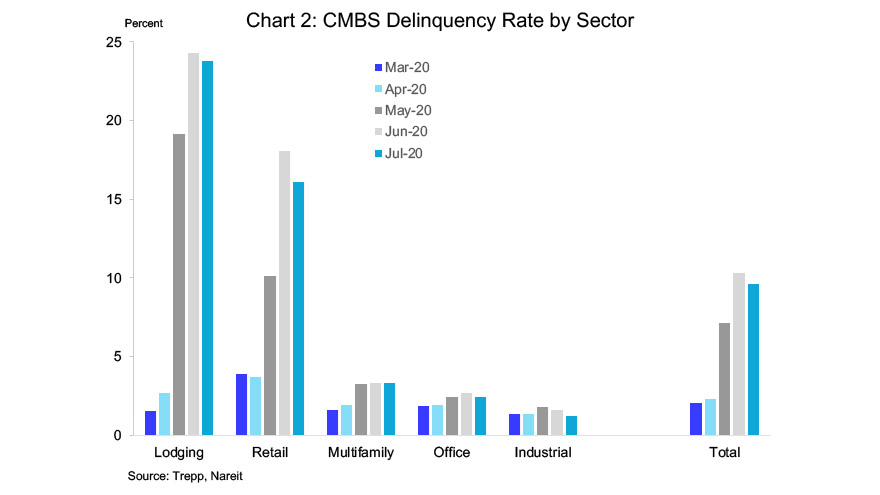

Cbms Delinquency Rate Drops In July Nareit

Calculate Mortgage Discount Points Breakeven Date Should I Pay Points On My Home Loan

The Ultimate Mortgage Guidebook Homewise

Piti Find Out All That Goes Into Your Mortgage Payment

/cloudfront-us-east-1.images.arcpublishing.com/dmn/5GXLKWY2KNALZHSSTY5EZVA33E.jpg)

Motley Fool Fueled By The Pandemic Roku S Audience Is Growing

Transunion Monthly Industry Snapshot

Loan Performance Insights September 2022 Corelogic

Can I Get A 30 Year Mortgage In Canada Nesto Ca

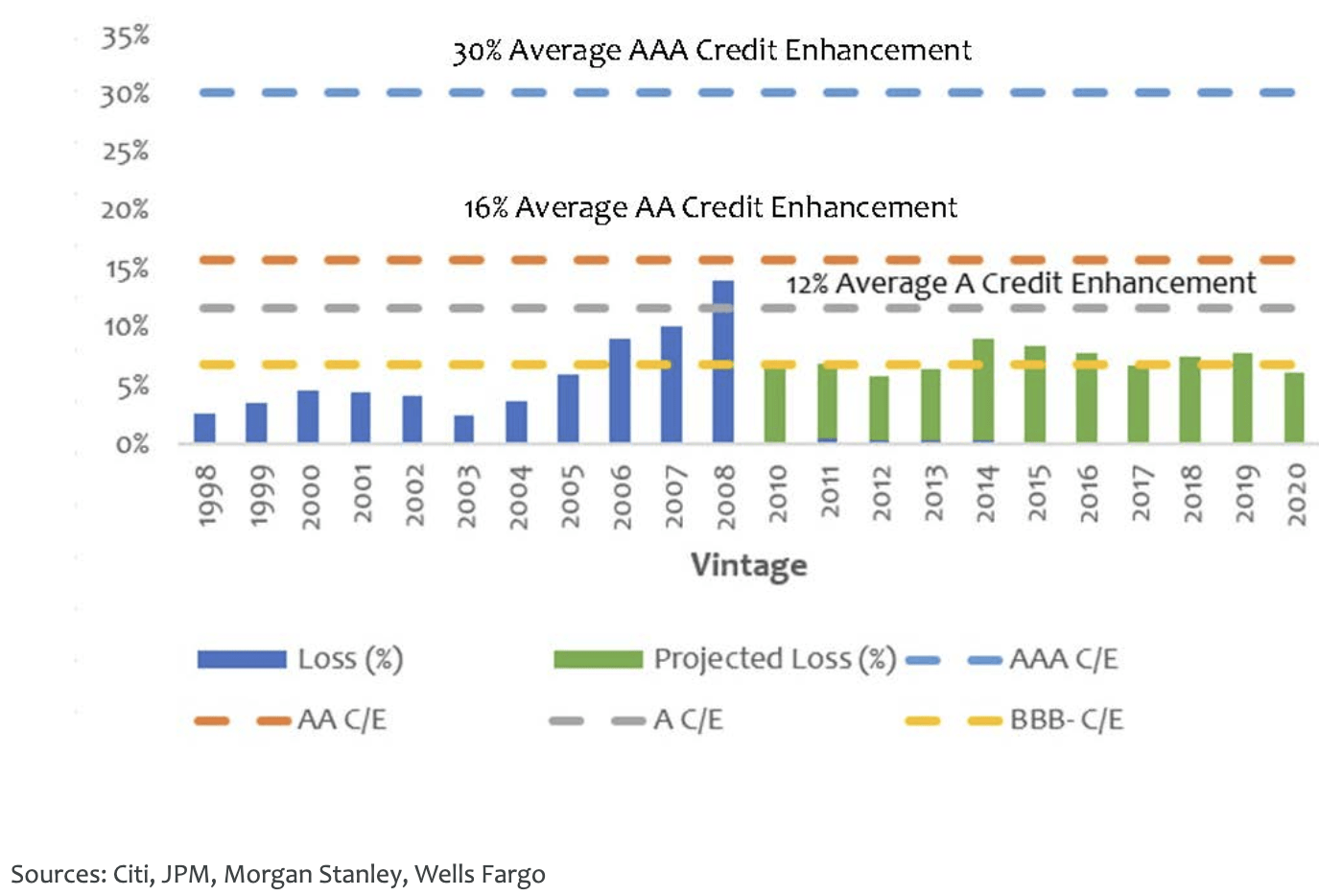

Commercial Mortgage Backed Securities In The Post Covid Economy Global Financial Markets Institute

What S The Speed Limit In Germany Quora

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Integrating Renewals And Correspondence Digital Benefits Hub

Another Piece Of The Puzzle Of Plunging Credit Card Balances Wolf Street